The Wall Street adage “Buy the rumor, sell the news” belies what is often observed in traditional markets but especially cryptocurrency markets: prices of crypto assets like Bitcoin (BTC) are often violently impacted by reactions to news stories. Cryptocurrency investors have an opportunity to capitalize on this sentiment-fueled volatility through intelligent analysis of the news.

Causality Link develops and deploys advanced natural language processing (NLP) software that automatically analyzes millions of news texts in dozens of languages, helps users interpret it and creates signals that track important indicators. As we expand our tool’s understanding of discussions about the outlook and drivers of cryptocurrency prices, we find a few similarities and some differences in the factors experts identify as the most important drivers of crypto asset prices compared to those of traditional markets.

In this post, we will look at seven often-cited cryptocurrency drivers that we have gleaned through analysis of public news. We will then show how artificial intelligence (AI) & NLP-powered tools like Causality Link can be used to:

- automatically understand and synthesize articles discussing these drivers

- create a crypto news “sentiment” or “outlook” tracker, and

- continuously improve signal fidelity by automatically detecting newly emerging drivers.

Bitcoin Price Partially Driven by The Same Indicators Driving Stocks & Commodities

Stock and commodity prices are largely driven by economic indicators (or KPIs) like the inflation rate, US Dollar strength, revenue, expenses and recently also ESG (Environmental, Social, Governance) metrics, like carbon emissions or diversity. Some of these KPIs also influence cryptocurrency prices. Today we examine the impact of ESG rating (environmental footprint in particular) and inflation rate on crypto prices.

1. Environmental Footprint & Other ESG Issues

In the same way that Larry Fink of BlackRock kicked off the ESG investing revolution with his 2020 shareholder letter in which he advocated for investing in companies fighting climate change, so too did Elon Musk ratchet up pressure to make Bitcoin mining greener with his announcement that Tesla would no longer accept Bitcoin payment until at least 50% of mining is fueled by renewable energy. Bitcoin plunged as much as 14% within hours of the announcement and has not yet fully recovered. The good news is that tracking Bitcoin’s environmental footprint is a lot more straightforward than measuring ESG ratings for companies. This article from Decrypt provides a great overview of some common methods for calculating Bitcoin’s environmental impact while also touching on some more complex adjacent issues.

The math becomes messier when we consider that Bitcoin’s ESG impact goes beyond carbon emissions from mining. Cryptocurrency use is associated with illegal activities, like ransomware attacks, tax evasion and sales of illicit products and services. On the other hand, it is hailed by human rights activists for helping those in authoritarian regimes evade hyperinflation, predatory remittance fees and mass surveillance. The discussion on these viewpoints and related topics is ongoing and evolving. Having a solution like the Causality Link platform to monitor and evaluate these conversations provides invaluable and many times overlooked insights.

2. Inflation Rate

Gold and Bitcoin have been touted as hedges against inflation so that, when investors see inflation going up, they usually expect upward price pressure on gold and bitcoin. At least that used to be the expectation.

When querying our system for the drivers of Bitcoin’s price, the US inflation rate appears as one of the most strongly-linked macro-economic drivers. When exploring the inflation rate link, you are met with articles with headlines like this:

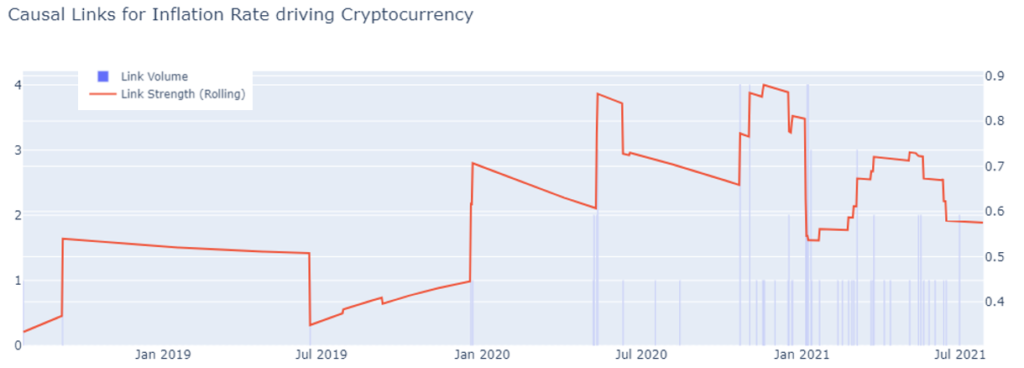

After zooming in on the strength and direction of that link over a few years, both seem to be shifting. Initially, authors talked only occasionally about inflation expectations driving cryptocurrency prices up, as can be seen by the low frequency of blue bars on the below chart prior to mid-2020.

The strength and direction of the causal statements is shown in aggregate by the red line above the blue bars. Upon review, one can see an upward trend that reaches a peak in early 2021 when Bitcoin crossed new all-time highs of $30K and $40K shortly thereafter. The volume of discussion around cryptocurrency (blue bars) has remained high since then, however the strength of the inflation link has weakened, meaning that instead of everyone talking about higher inflation increasing crypto prices, some are mentioning either no relationship or a reversing relationship.

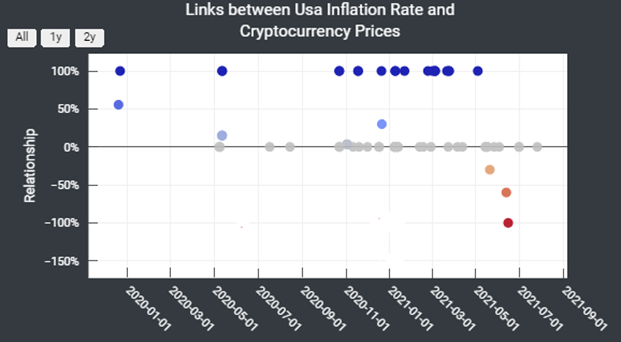

Another way to explore this trend is with the plot below, captured from within the Causality Link system. The blue dots indicate statements of a positive link between inflation and crypto prices. The color intensity and value show the strength of conviction of the statements. Notice the appearance of red dots, since May, indicating an inverse relationship:

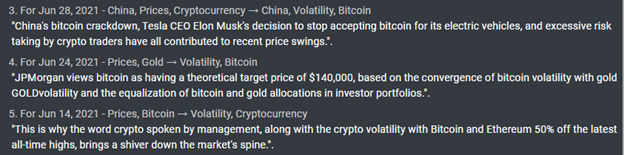

Clicking on the dots allows us to quickly see the most relevant quote, or to read the entire article. Here are a few sample headlines debating this narrative:

Spanish article translated into English, link

Bitcoin’s Other Price Drivers

On large price-swing days, crypto news headlines overwhelmingly credit the moves to specific events rather than to economic (or environmental) indicators like those discussed above. This is not to say that world events don’t rile up stock markets as well. Supply chain disruptions, legal actions, disasters, cyber hacks and the like have caused significant stock price movements. The difference with traditional markets is that a larger proportion of the discussion around traditional asset price movements attributes the moves to slower-shifting outlooks on macro- and micro-economic fundamental indicators, such as a) chip shortages that hurt production, b) oil price increases that drive up expenses or c) missed sales expectations that lower revenues and earnings.

The link between world events and crypto prices is not only used to explain price changes after-the-fact. We see the same pattern of mostly event-driven causal links in analysts’ statements about the drivers of future cryptocurrency prices. For instance, when analysts throw out Bitcoin price target predictions, their estimates are peppered with caveats about future events happening or not happening, like approval of a crypto ETF, mining bans or other regulation. There is far less rationalization based on shifts in economic indicators.

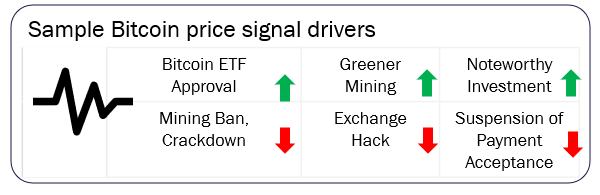

What follows are some broad categories of events that various authors have cited in explaining crypto price movements, either actual or hypothetical. For each event type, there are a few sample headlines [1]. If the title indicates an explicit connection between the event and Bitcoin’s price, we encode this a causal link. Where the language indicates either an increase in price or something that could push the price upward, we consider that a favorable signal. Likewise, an unfavorable signal means the discussion is about something that is expected to push prices down.

3. Crypto Buy/Sell/Endorsement from Industry Icons (People or Companies)

Causal Link & Favorable Signal: Bitcoin price hike after Nasdaq-listed company buys $150 million worth of cryptocurrency (Published in Express.co.uk)

Favorable Signal: “I Have Some Bitcoin”: Dalio Prefers Bitcoin To Bonds, Thinks Ethereum Is More Efficient (Published in ZeroHedge)

Causal Link & Favorable Signal Bitcoin Price Rises as Paul Tudor Jones Backs the Crypto (Published in Newsweek)

Causal Link & Unfavorable Signal: JPMorgan Says Grayscale Share Sales Extra Headwind for Bitcoin (Published in BNNBloomberg)

4. Launch, Application or Expectation of Crypto Investment Instruments

Causal Link & Favorable Signal: 5 Possible Reasons for Bitcoin’s Price Surge Over $30,000 [The Expectations Around an ETF] (Published in Cryptopotato)

Favorable Signal Cathie Wood’s ARK Invest files to offer a bitcoin ETF (Published in Fox Business)

Causal Link & Favorable Signal: Bitcoin’s Price May Surge Once an ETF Is Approved, Crypto CEO Says (Published in CryptoGlobe)

Favorable Signal “Why a U.S. Bitcoin ETF Could Be a Real Thing in 2021” (Published in Bloomberg)

5. Acceptance (or Withdrawal) of Crypto as Payment

Causal Link & Favorable Signal Bitcoin Sees Bullish Sentiment Return After PayPal Announces Worldwide Cryptocurrency Payments (Published in CoinCodex)

Favorable Signal Apple Pay Crypto? What to Know About the Latest Apple Crypto Rumors (Published in BusinessInsider)

Causal Link & Unfavorable Signal Bitcoin crashes after Elon Musk says Tesla will stop accepting the crypto as payment (Published in TechSpot)

Causal Link & Favorable Signal Bitcoin surges above $40,000 after Elon Musk says Tesla will resume crypto payments when mining is cleaner (Published in Business Insider)

6. Regulatory Changes/Hurdles/Bans

Causal Link & Unfavorable Signal How language in the infrastructure bill could roil the crypto markets (Published in CNBC)

Causal Link & Unfavorable Signal Bitcoin Price Shoots to 3-Month High Amid ‘Disastrous’ $1.2 Trillion Infrastructure Bill Controversy (Published in Independent)

Causal Link & Unfavorable Signal Bitcoin falls below $30,000 after China’s crackdown (Published in CNET)

Unfavorable Signal China urges banks, Alipay to crack down harder on cryptocurrencies (Published in Reuters)

Causal Link & Favorable Signal Bitcoin Jumps After El Salvador Says It’ll Start Accepting It as Legal Tender (Published in CNN Business)

Favorable Signal Support for making Bitcoin legal tender grows in Latin America. (Published in Fortune)

7. Security Privacy Issues

Causal Link & Unfavorable Signal Bitcoin prices sink after FBI recovers Colonial Pipeline crypto ransom (Published in CNBC)

Causal Link & Unfavorable Signal Bitcoin Price Still Bruised After Bitfinex Hack (Published in CoinDesk)

Unfavorable Signal Hacking bitcoin wallets with quantum computers could happen – but cryptographers are racing to build a workaround (Published in CNBC)

Why does it matter whether economic indicators or events are better predictors of Bitcoin’s price?

It’s relatively easy to source alternative data feeds that track inflation, US dollar strength and certain ESG metrics, like the energy impact of Bitcoin mining. It’s much harder to systematically track fuzzier sentiment-type measures, such as the aggregate outlook on the various current and potential future events that could impact crypto prices, or what proportion of the overall discussion across thousands of articles is generally favorable versus unfavorable to the price of a particular cryptocurrency. Yet it’s worth the effort to try to track these measures because it’s potentially more valuable for crypto investors. This is also why we at Causality Link continue to invest in understanding and properly detecting all the forces influencing markets, including those for cryptocurrency.

Systematic News Analysis Using NLP

Our first step in making the news analyzable is to use advanced NLP to break down every article, report and headline into the lowest-level sub-components. This means extracting and cataloging all the mentions and context around the discussed companies, industries, commodities, geographies, events, economic indicators and a host of other topics in nearly 30 languages. Now let’s explore some of the interesting things you can do with the massive, structured catalog of insights developed by performing this process on more than 100 million articles from around the globe.

Answering Questions about Cause and Effect

Causality Link’s software is able to understand language in which authors directly associate two things, such as a Tweet by Musk impacting the price of Bitcoin. We call these causal links. By joining these causal links together over time and across publishers, we get a massive model of the ever-changing forces acting on the world. From this, we can then ask the system any number of questions (queries), such as, “If there’s a regulatory enforcement crackdown , which companies and countries would be the biggest winners and losers?” Below is the output from a simpler query, in which we ask the system to take us directly to articles in which authors are explaining either the causes of Bitcoin’s price volatility or its impact on other parts of the market.

Creating Trackable Signals/Indexes

Causality Link measures market sentiment by tracking the frequency and conviction of mentions of economic indicators and any forces that have or could push them up or down. We call these “Indicator Trends”. These indicators could be, for instance, Bitcoin’s price, Tesla’s ESG rating or Coinbase’s profits. The Trends on those indicators would be any increase or decrease in mentions of these factors.

We also understand how indicators relate to one another, like EPS and EBIDTA being sub-indicators of profit. In addition to an indicator hierarchy, most indicators are also tagged as favorable (e.g., profit and revenue) versus unfavorable (e.g., risks and expenses). This understanding allows us to aggregate all Indicator Trends from tens of thousands of daily articles into a trackable indicator-based sentiment score.

Below is the output of Causality Link’s combined cryptocurrency news sentiment score (red) overlaid with BTC price chart (blue). Causality Link’s signal today is focused more on indicators than events, but there’s already some congruence between the signal curve and Bitcoin’s price movements, including the most recent dip in late spring 2021 that corresponded with the China mining ban and overall crypto price pullback:

We have an opportunity to improve signal accuracy, granularity and configurability by also incorporating mentions of events like those discussed here. More specifically, here is a simplified depiction (e.g., without weighting) of how individual mentions of these sorts of events could move the signal:

Preparing for an Uncertain Future

Outlier events occur in the crypto space almost constantly. Although many of these triggering events follow common narratives like those mentioned above, truly unprecedented events are quite common, such as Tesla’s backtracking on the acceptance of Bitcoin as payment due to environmental concerns, El Salvador’s acceptance of Bitcoin as legal tender or the US government’s covert seizure of crypto assets from a Russian ransomware group. Many of these events, whether black swans, reinforcement of existing trends or unraveling of historical narratives, set off a cascade of reactions (and sometimes overreactions) and corresponding price movements that may be foreseeable given enough quality data and effective analysis methods.

For systematic news analytics methods to produce consistent value for investors, we believe these tools must support the following capabilities:

Quickly detect market shifts

Market drivers sometimes drift slowly in ways that aren’t obvious to those preoccupied with the latest market drama. For instance, the weakening relationship between the inflation rate and Bitcoin’s price has been gradual and will likely shift again. The impact of regulation has also shifted, though much more dramatically. The China mining ban in June swiftly dampened crypto markets. One might therefore have expected new regulatory burdens in the US to have the same effect, but that’s not what happened since July 28. That’s when US legislators inserted an 11th hour amendment to the US infrastructure bill that imposed onerous tax reporting requirements on anyone involved in crypto transaction processing, effectively making it impossible for non-custodial crypto technology providers to be able to legally operate in the US. Over the following two-week-long period of furious criticism and attempted rewrites of this provision, crypto prices eased steadily upward in “defiance” of the legislation, as it was initially described. The narrative then shifted to one of a “coming of age” of crypto, as presented in this Fortune article and reinforced by many other articles as a necessary growing pain of this new technology. News analytics tools should support the automatic detection of these shifts in market drivers. Tools should also be able to detect and incorporating new concepts, whether people, companies, events or instruments (stablecoins, NFTs, CBDCs, etc) as impactful discussions about them appear or accelerate in the news.

Factor Weighting

Users should be able to custom-configure signals or indexes that incorporate the factors that they care most about, including new factors not obvious to others. This could be achieved, for instance, through customized weighting of the contribution of these factors to the signal.

Leverage the broadest uncorrelated content & expertise

Bias and hidden agendas are at least as prevalent in crypto markets as in broader financial markets. The antidote to this problem is to cast a wide perspective net so that the views of a great variety of subject matter experts are considered.[2] This may span different publishers, languages, geographies and sub-topic domains. Text analytics tools should be able to leverage a large corpus of texts including research articles, transcripts of calls or presentations and proprietary or in-house content in addition to public news. Publisher or author-level weighting should also be supported to further reduce bias.

What-if analysis

Market analysis is never a pushbutton exercise. Tools must support interactive analysis and scenario testing to help understand the consequences of potential future events, such as what might be the downstream impact of a ban or hack of a major cryptocurrency exchange or which securities are expected to fare the best and worst as a result.

In the rapidly evolving and highly volatile world of crypto markets, AI- and NLP-powered solutions that can synthesize the thoughtfully articulated insights of a broad range of experts present us with wholly new ways of evaluating risks and opportunities. Perhaps more importantly, this technology may help us better prepare for an increasingly uncertain future.

Do you think that news or other text content can be useful in predicting crypto asset price movements? If you could convert that content into signals, metadata, dashboards and alerts that help inform your investment decisions, what would you want to be able to detect and analyze? Reach out and let us know!

— Nevra Ledwon, Director of N. American Sales at Causality Link

August 18, 2021

Authors tend to agree on the directional favorability of most (though not all) events they explicitly connect to crypto price swings: regulation, bans and security or privacy lapses are believed to exert downward price pressure whereas new investment in crypto, bullish public sentiment by industry figureheads, and wider acceptance of Bitcoin as a form of payment are seen as upward-driving signals.

Taking it to the next level, one could refine the signal by expanding the list of both past and future potential events and their expected influence on BTC price and even apply appropriate weighting based on various factors.

[1] For the purposes of this article, we selected representative headlines from publicly accessible articles that readers can directly access rather than articles that come bundled into the Causality Link solution because our content licensing arrangements do not allow us to share those articles outside of our customer base.

[2] We say “subject matter experts” deliberately because social media sentiment is its own animal as evidenced by the past year’s events on platforms like Reddit. That’s not to say that mining of social media isn’t valuable, but we believe it’s easier to reduce the “echo chamber” effect and other spurious noise when you focus on authors who often also monitor those sites and then go on record with their viewpoints vs. posting hastily and anonymously.