Pierre Haren, PhD

Pierre Haren is the founder and CEO of Causality Link, an AI start-up in finance that reads millions of documents to build a graph of the forces acting on the world. Pierre was for 22 years the CEO of ILOG, a Nasdaq listed company specialized in Artificial Intelligence and Operations Research.

Laurent Gouzènes, PhD

Laurent Gouzènes is the founder of KM2 Conseil, an AI start-up specialized in knowledge management and automated generation of documents and programs. He was for 17 years in the strategic planning group in charge of building new plants and cooperative research programs for STMicroelectronics, the European leader in semiconductors.

Read below or download the full paper here.

We argue in this paper that China annexing Taiwan is not a matter of if but a matter of when. We leverage the Go metaphor to understand the different moves that the US and China are making on the topic, and to predict which conditions will lead to the conclusion of that serious international game.

The rise of China has been the subject of numerous analyses recently, and its bold decisions, such as the One Belt One Road project, the growth the Chinese military, its investments in Africa, its recent crackdown on its tech industry and its military incursions in the South China Sea are often analyzed in isolation.

In parallel, the consequences of the 2018 decision by the Trump administration to engage in a technological decoupling with China, the increased attention of the Biden administration on the Asia-Pacific zone and the chip shortage worldwide have also been analyzed independently and often point to Taiwan as a potential flash point of the US-China relationships.

In this paper, we use the concepts of the game of Go to analyze these decisions in the context of the decades-long power game of China versus the US to assess the conditions and probability of the countries’ next moves.

Differences between Western and Chinese thinking and the game of Go

French philosopher Francois Jullien has summarized the thinking difference between the Western and Chinese civilizations in his book “The Propensity of Things” [1]. Western civilization has been influenced by the Greek concepts of causality, which fuels the “free will” and democratic ideals. Decisions made by individuals modify the world. By contrast, Chinese see the potential of situations and strive to influence this potential in the desired direction. In a way, we could say that the Western civilization believes in Newtonian mechanics driving the world versus a Chinese quantum mechanics “force field” point of view.

One of the best ways to leverage Francois Jullien’s philosophical points is to analyze the current worldwide power play of China through the famous Game of Go.

Highly popular in Asia, the Go game is a very ancient strategy game with 2 players. The game has been used numerous times to illustrate the difference of thinking between East and West, as a model for business or war and as an example of the difficulty of marrying strategy with tactics.

The rules are very simple to learn, however becoming an expert is a lifelong challenge. The game is played on a board with 19×19 intersections. White and black stones are placed successively and once placed they cannot be moved, but they can be captured. The goal of the game is to build the largest territories whose frontiers are made of connected stones of the same color. Standalone stones or small territories can be captured by surrounding them.

Winning, contrary to chess, is not achieved by crushing the opponent but by outperforming him. Players must be strategic in the placement of stones to delimit the frontiers of larger territories.

The game is played in three phases: the opening (“Fuseki”), where players are sketching the frontiers of territories and influences; the middle game (“Chuban”) which starts when the first fight breaks out, usually after one of the players feels like he/she has less potential than the opponent so “something must be done”; the final game (“Yose”) where players optimize territories in order to gain their last points.

Some characteristics of the game bear a striking similarity with the actual geopolitical moves:

- Advantages are built gradually and the final win is obtained through progressive and efficient placement of stones;

- Patience is key, as a game of Go requires time to place more than 300 stones. In ancient times, a game could last one month or even more (cf Kawabata’s novel [2]);

- One must simultaneously consider multiple zones, because even if some part requires immediate attention, placing stones far from the present fighting place can lead to long term advantages;

- One must focusattention on the potential, not the guaranteed so that as soon as you know that your opponent cannot prevent you from capturing some stones, you focus on other parts of the board.

The game of Go reflects the Chinese philosophy that the goal is to build harmony and less to fight, so winning is achieved by creating the best force field and harvesting its benefits.

In that spirit, China has been playing a long game in its development. The controlled migration of most of its citizens to cities (equivalent to the construction of one city of 20 million inhabitants every year for over 25 years since 1982) and the rapid growth of its universities and higher-level education (China is forecasted to produce 77,000 PhDs per year in STEM by 2025, versus 40,000 in the US) are the consequences of decisions made by the leaders of the Communist Party. The opening to private enterprise and a capitalist system has unleashed the energies of the last two generations of Chinese citizens.

The result has been a rapid rise of the GDP per inhabitant in China, as well as a rush towards science and advanced technology which delivers impressive results. China has built a super-computer that was ranked in the past two years at the TOP 500 list of super-computers. It was first to demonstrate the capacity to send quantum bits between space and Earth. It has its own space station in orbit and in 2021, demonstrated the ability to land safely a rover on Mars. It has the largest network of high-speed trains and is now in the lead for the development of Very High-Speed Trains. It produces most of the solar panels of the planet, it fired the first nuclear thorium reactor. And more.

Shanghai and dozens of other cities in China now enable a lifestyle very similar if not better than Taipei, and some of the Taiwanese CEOs we know oscillated (pre-Covid) between Shanghai and Taipei as their American counterparts commuted between Boston and Palo Alto.

These business and cultural moves of China have considerably reduced the differences that existed between the mainland and Taiwan.

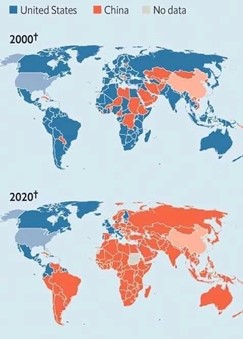

On the world stage, China has continuously reinforced its commercial relationships with most countries, and this chart shows how China over the course of the past 20 years has replaced the US as the main trading partner of almost every country in the world [3].

As an experienced Go player, China is clearly placing stones and pushing to increase its influence everywhere.

The announcement in 2013 of the “Belt and Road Initiative” was another important long-term move to increase the connectivity of the Eurasia continent and subsequently decrease the strength of its links with the US while pushing the boundary of the influence competition much further west – a key move in Go.

Why Taiwan is so important to China

Taiwan is an island in the China sea about 110 miles from mainland China. The two countries have a complex history, including two separate waves of millions of Han immigrants from mainland China overpowering the natives over the past 200 years, domination by foreign powers (Dutch and Japanese) periodically overturned by mainland China emperors and a brief re-unification with the mainland after WW II. That is until 1949, when Chang Kai Tchek fled to Taiwan/Taipei, which he declared the capital of China while his opponent Mao-Tse-Dong vowed that the new communist People Republic of China would reunify China and Taiwan.

In 1979, in view of the rapid progress of the economy of mainland China, most of the world powers decided to drop their recognition of Taiwan/Taipei as the representative of China and shifted the representation of China to the PRC and Beijing. The geopolitical status of Taiwan was left in limbo as the PRC refused that Taiwan be recognized as an independent country and got them kicked out of the UN Security Council.

Since then, China/Beijing have been steadfast in its refusal of recognizing the independence of Taiwan but have constantly increased its commercial and industrial links with the island. Chinais now the largest trading partner of Taiwan, its imports and exports to China about double those of its next partner, the US. This is in large part facilitated by a common culture of hard work and belief in science and Mandarin as a common language.

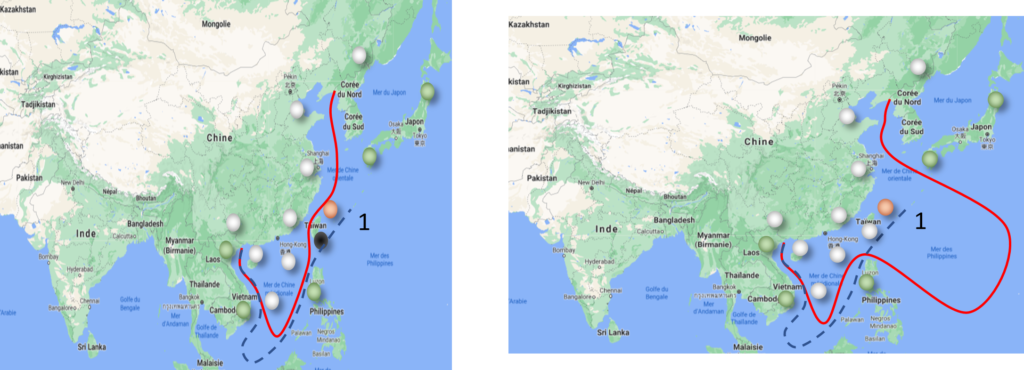

Apart from these very strong economic ties, Taiwan is important for China because of its geographical situation, providing China with a strong position in the China Sea, and access to the riches of its continental shelf; and because the success of a Han democracy at its doors could be a dangerous counterexample of the superiority of the current Chinese political system.

Why Taiwan is so important to the US

The US relationship with Taiwan was defined by the 1979 Taiwan Relations Act, which shifted the official recognition of China by the US to the People’s Republic of China and laid the rules for the “unofficial” relationship with Taiwan. To appease Beijing, the US did not officially recognize Taiwan as a country but however committed to assist Taiwan in maintaining self-defense capabilities. The US encouraged both parties to a peaceful resolution of the Beijing/Taipei differences.

Over the past 40+ years, this “policy of deliberate ambiguity” has been clarified through communiques and official declarations, up to Mike Pompeo’s Press Statement of January 9, 2021 [4].

The key political reason for the US’ support of Taiwan is their commitment to a democratic regime. The key geo-political reason is the freedom of maritime transportation across the China Sea. And the key business reason is the strong dependence of the US economy to Taiwan’s electronics industry.

Indeed, over the years, Taiwan and its 24 million inhabitants have built a unique position in the semi-conductor industry. Most notably with the Taiwanese TSMC, the largest manufacturer of electronic chips in the world, which provides these essential components to iconic US companies such as Intel, Apple, General Motors and hundreds of others [5]; and the world largest contract electronics manufacturer Foxconn, whose 1.3 million employees assemble all the Apple iPhones, and thousands of other electronics devices for the whole industrial world.

The importance of TSMC to the Western economies cannot be underestimated. It stems from its dominance of the global semiconductor industry, providing chips for about 40% of the industry, representing more than $200B in revenues, and in turn delivers electronic parts for about $2,500B of electronic equipment, which are critical in most of modern industries (computers, telecom, automotive, etc.) and leading companies (Apple, Nvidia, Qualcomm, AMD, etc.).

As of today, a major disruption of Taiwan’s chip industry capacities would completely cripple the Western economies and military infrastructure within years, if not months.

The semi-conductor flash point

The current semiconductor chip supply shortage has brought a lot of attention to this very technical industry. In the past quarter, the world simultaneously discovered with astonishment our profound dependance on these components, and the major role that Taiwan is playing worldwide.

An excellent analysis of the semi-conductor industry in the Chinese context has been produced in 2021 by the French “Institut Montaigne” under the title “The Weak Links in China’s Drive for Semiconductors” [6].

To summarize, the highly technical foundry business for advanced semiconductors is a duopoly controlled by TSMC in Taiwan (50% of the market) and Samsung in South Korea. These chips then diffuse in all the modern industries (communications, transportation, computing, electronic equipment, etc…) that define twenty-first century lifestyle.

Moreover, the modern “fabs” that produce these chips represent huge investments (over $20B each) in hardware, manpower and process that are not easily replicated. For example, the latest lithography equipment from Dutch company ASML, which leverages the most recent EUV (Extreme Ultraviolet) technology, costs upwards of $150M per machine, and a modern fab needs tens of such machines.

TSMC rose to its prominent position in the electronics space through many competitive advantages. It was a spinoff from ITRI, the major government R&D lab in Taiwan and heavily benefited from its installation in the Hsinchu Science Park, which was a haven for investors by the 90’s thanks to generous tax incentives and active “reverse brain-drain” to bring back talent to Taiwan.

TSMC has also constantly played the long game. In 1997, TSMC announced an ambitious, ten-year expansion program that called for a huge investment of $14.5 billion in the construction of six eight-inch and 12-inch (300mm) fabrication facilities as well as other facilities, which were by that time larger than the whole European industry [7]. In 2021, TSMC announces another $100B investment plan [8].

By contrast, the Chinese semi-conductor industry has lagged in technology and revenue.

SMIC is the major Chinese foundry, but its revenue is about 1/10 of TSMC and its process and technologies lag years behind TSMC. China has created its first chip industry seed fund in 2014, and subsequently increased massively its funding to “the Big Fund” to develop a competitive semi-conductor industry.

This drive to autonomy in semiconductors has certainly accelerated after the “technological decoupling” of China and the US that started during the 2016 presidential campaign in the US and was accelerated by the 2018 tariffs and bans of the Trump Administration. Such bans have reinforced the urgency of a strategy that China had started years ago in the semi-conductor space. However, that strategy requires more than funding, it also requires people and technology.

A US Congress report of April 2021 noted that: “The new policies’ staffing criteria may necessitate foreign talent given reports of apparent talent shortfalls. Semiconductor capabilities rely on decades of knowledge and expertise. In an effort to advance rapidly in the industry, China has deployed a set of policies to encourage the return of expatriates, the hiring of specialized industry talent (particularly from Taiwan), and cross-border exchanges of expertise through formal agreements and exchanges. Under these policies, Taiwan has reportedly lost an estimated 3,000 semiconductor engineers to China since 2015. For example, the top executives of China’s SMIC are the former Chief Operations Officer and R&D director at Taiwan’s leading foundry, TSMC.”

As far as technology goes, it should be noted that most of the advanced machines required inside the fabs are manufactured by a small number of companies: the Dutch ASML, the American Applied Materials, Lam Research and KLA-Tencor and the Japanese Tokyo Electron.

The export restrictions imposed by the US Export Administration Regulations (EAR) to China currently prevents the expansion of the Chinese fabs and all technology progress until equivalent equipment becomes available from China. These machines are extremely complicated and precise. They also rely on the integration of different scientific competences, as well as on the supply of adequate ultrapure chemicals. Reinventing 70 years of Western machine development in China is not an easy task and the specialization of the western providers in the complex worldwide semiconductor food-chain tells a lot about the challenges faced by China as an isolated player.

Given the strategic importance of such technology, one should follow with attention the Chinese efforts to achieve parity in that space, through all means available.

Two additional factors must also be considered to understand the different catch-up strategies available to China: the first factor is the possible physical limit that will be reached within at most two generations of chip design, and the second is the potential of quantum computing.

The current state of the art is called 5-nanometer technology and is in full production at TSMC in Taiwan for example, with a full order book dominated by Apple. The next generation is 3-nanometers, to be deployed in TSMC Tainan in 2023. There is at most another generation after this 3-nanometer, because the size of the chip engraving is getting too close to the size of the atoms of the wafer. What that means is that there will be a period where the Chinese SMIC and others (which are today at the 14-nanometer generation) can catch up because progress will be slowed down by the pure physics of the process.

As for the potential of quantum computing, it is still in its infancy, but the aggressive Chinese investment in that space has led a team of Shanghai researchers to pre-publish in July 2021 a paper about the fastest quantum computing in the world. While quantum computing is not for cell phones, it could provide China a technology advantage in general super-computing, which to this day relied on usage of the most advanced semi-conductor chips.

Now what?

Having painted a global picture of the current dynamic situation around Taiwan, we can consider some of the next moves of the players in this “Chuban” phase.

First, the current utmost dependency of the US on TSMC would justify a war if China were to try to take control of Taiwan in the short term. We believe that the Chinese know it, as well as US decision makers. This guarantees a short-term stalemate while China and the US are trying to reinforce their force field in other dimensions.

However, the situation can evolve in multiple directions.

First, the US are aggressively trying to repatriate some foundries to the homeland, encouraging Intel to build new fabs, asking TSMC to build a fab in Arizona and promoting Global Foundries local efforts. At this point, TSMC will not build the latest technology in Arizona, as the US dependency on their most advanced technology appears to be a strong guarantee of Taiwan’s independence. These efforts will take time, as it takes more than four years to build such a fab, and many are required to achieve US manufacturing independence.

Second, we should not underestimate the Chinese efforts in the semi-conductor space, which have been accelerated by the Trump administration embargo measures maintained by the Biden administration. Full autonomy in the semiconductor space by the Chinese will be a very important milestone to observe, as China imported $304B of semiconductors in 2019. Today they could not afford a full embargo from the international community on these goods. Although we estimate the necessary R&D expenses to “catch up” in semi-conductors to be in the 200-300B$ range, this is clearly affordable by China.

We believe however that once the two “decoupling objectives” of semiconductor independence are achieved in the US and in China, in the coming 10 years, it will become extremely difficult for most nations to justify a war preventing China from annexing Taiwan.

The relative speed at which China will achieve semiconductor parity and the US will achieve semiconductor independence determines the relative force fields and the most probable next moves: from a peaceful reunification leveraging the joint Taiwan/China technology pride and culture which, in the short term, would not perturbate the operations of TSMC to a military annexing threatening to cut semiconductor supply by the destruction of the TSMC fabs.

The current status quo can only be prolongated as long as the US maintains their dependency on TSMC in Taiwan and China does not feel ready to absorb a chip embargo from the rest of the world.

Conclusion

The steady progress of China towards Taiwan results from its long-term unwavering commitment to a reunification between the mainland and the “dissident” island.

If we analyze China’s strategy through the prism of the Go game, the overall strategy is very clear. Using time, a lot of its financial reserves and the huge availability of talent, China can play a very powerful game, placing several stones at the same time with a huge advantage. The strategy of the two centenaries [9] has set goals of prosperity for 2049, enough time to become independent and access to top technology in semiconductors.

It is our conviction that the current state of the Taiwanese independence game hinges on the evolution of the electronics dependency the US and China have developed over the years.

If China succeeds in developing competing chip manufacturing technologies in the coming years, the potential threat of an embargo by Western countries on such technology will vanish as an economic deterrent to an annexation of Taiwan by China.

If massive investment efforts to repatriate the “fabs” in the US and Western Europe succeed, the Western willingness to go to war to save the independence of Taiwan will decrease.

If on the contrary, Taiwan semi-conductor industry remains an essential element of the Western economies, our own dependence on their production is their best guarantee to the continuation of the status quo, or to World War III.