Investing in companies that share your values may seem like a novel concept in an industry that’s historically been all about the bottom line, but this is changing quickly. As the tumultuous events of 2020 amplified conversations the world over about climate change and social justice, investors quickly turned their attention to the role of corporations in shaping the future of our world.

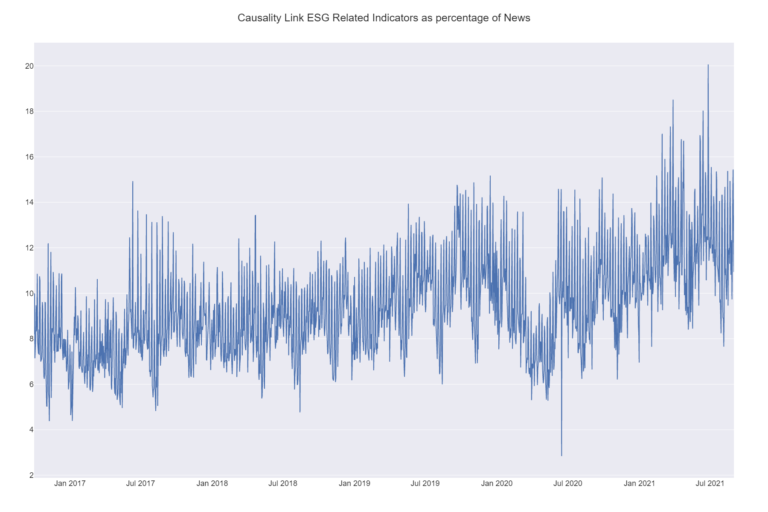

Environmental, social and governance (ESG) investing — a sustainable investment strategy that specifically considers those factors — has proven itself to be far more than a passing fad, transforming from a niche practice to a rapidly expanding sector. According to data obtained from Causality Link — a provider of AI-and NLP-derived financial intelligence, including ESG metrics — media attention on ESG-related topics, which had been in decline at the outset of the pandemic, hit a new high in late June 2021, peaking at just over 20% of all media coverage and resulting in a surge in demand for investment vehicles that promote these causes.

This chart indicates that media attention on ESG declined around the emergence of COVID-19 and then quickly recovered to a new high, peaking at just over 20%, or 1 in 5 indicators in the entire system, around June 26, 2021.

“Firms must be much more detailed and precise in categorizing specific initiatives or measures that they value in relation to ESG. This work is laborious and incredibly difficult, as it can be industry-specific and include indicators that are not necessarily measured consistently or with the same rigor as is applied to balance sheets using GAAP,” said Pierre Haren, Co-founder and CEO of Causality Link. “It is necessary for firms to have a method with which to weigh factors and to cap those factors’ contribution to an overall score in order to avoid greenwashing, which would boost a company against measures that are not material to the business.”

“To aid asset managers, Causality Link has designed a set of algorithms that can be tailored by customers and blended with their own structured data dynamically,” added Causality Link’s Haren. “Our AI-driven platform constantly monitors world news in a number of different languages, bringing key information that would have otherwise been overlooked by company disclosures. For instance, we monitor for actions by companies that behave differently than their disclosures suggest, including their subsidiaries and suppliers.”

Read the full article on TabbFORUM here.